CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

As economic uncertainty persists and consumers continue to weigh their spending priorities in 2026, the clothing rental services category may be one area poised for growth. Platforms like Rent the Runway and Nuuly offer an alternative for shoppers looking to save, stay on trend, or experiment with new styles.

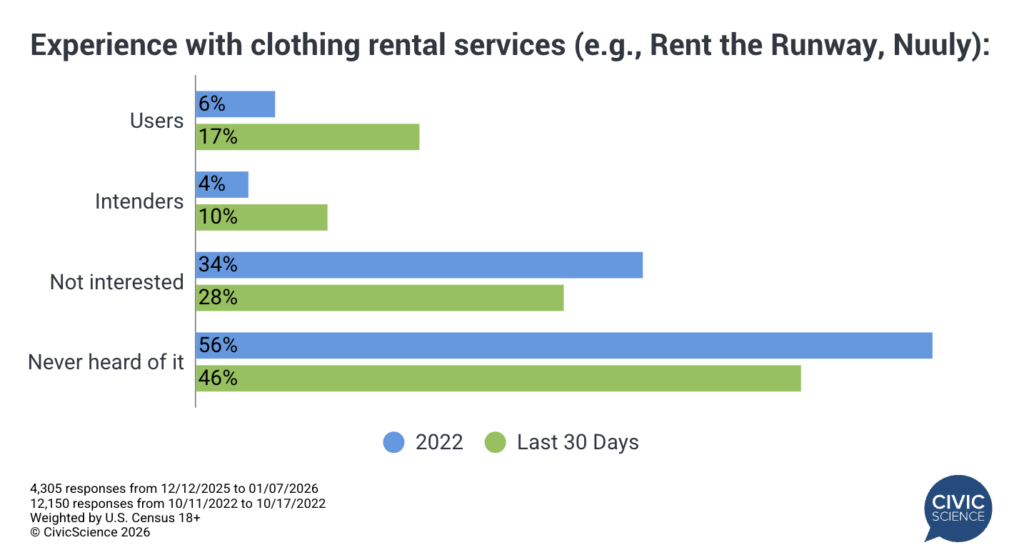

The latest consumer declared data from CivicScience shows that adoption is on the rise: 17% of U.S. adults now say they’ve used a clothing rental service, while an additional 10% haven’t yet but plan to. This reflects a significant shift in the market, with usage nearly tripling and intent more than doubling in recent years. Simultaneously, overall awareness is up, while the portion of consumers considering themselves uninterested continues to decline.

While appeal for clothing rental subscriptions skews younger and female, an awareness gap among older Americans and men suggests potential market growth opportunities. Likely tied to age, reported interest is strongest among those earning under $100K annually, and parents also lead in usage.

Top Motive: Outfits for Special Occasions and Trips

When asked to select their top three reasons for using clothing rental services (among users/intenders, excluding ‘none of the above’), access to outfits for special occasions, trips, or vacations is the most commonly cited reason (22%), slightly outweighing cost savings (20%). Fewer say they use or would use these services for work-related attire (14%), to try out new styles (8%), or for sustainability-driven reasons (7%). Interestingly, motives remain relatively consistent across income levels, suggesting a broader interest that extends beyond cost-saving benefits.

Life Changes & Wardrobe Preferences Set Clothing Rental Users Apart

Beyond demographics, clothing rental service users and intenders present key distinctions in lifestyle and life stage. Compared to those who say they’re not interested, users and intenders are significantly more likely to report experiencing major life changes – ranging from having children or becoming grandparents to moving to a new place or changing careers.

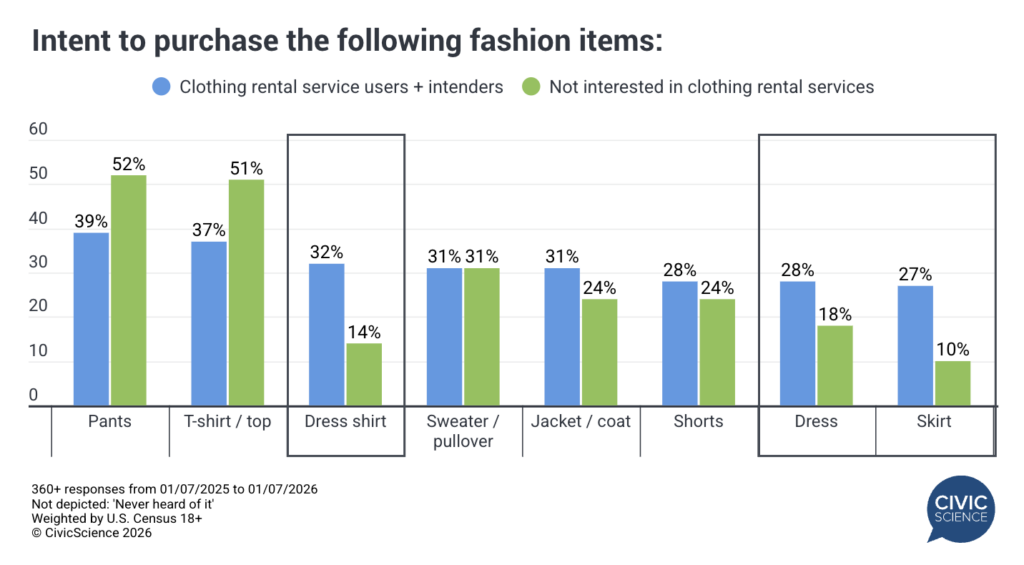

These differences help explain not only who is most drawn to clothing rental services, but why. Aligning with their top motivation – access to outfits for special occasions – users and intenders are far more likely to report plans to purchase apparel for special events such as dress shirts, dresses, and skirts. In contrast, those who are not interested in clothing rental services are more likely to report purchasing everyday wardrobe staples, such as casual tops and pants.

How to Reach Clothing Rental Service Users and Intenders

CivicScience data also reveal how brands and advertisers can effectively reach this high-opportunity audience. Compared to those not interested in clothing rental services, users and intenders are more likely to identify as early adopters, report paying closer attention to digital advertising, and watch videos when researching products.

Below is a preview of CivicScience’s capabilities, highlighting how users and intenders differ from those not interested:

As consumers continue to navigate spending challenges, clothing rental services appear well-positioned to benefit from shifting priorities around flexibility, access, and value. With awareness and intent rising, brands that align with life moments, special occasions, and discovery-driven marketing will be best positioned to capture continued growth in this category.